HISTORY & MISSION

The story behind the inception of JustFab Inc. (previously called JustFabulous) goes back to the early 2000s when Adam Goldenberg and Don Ressler, JustFab Inc. CEOs, worked in the Alena product marketing division of Intermix Media, the parent company of MySpace. Over the next few years, both men dabbled with a few controversial products including Sensa, a weight loss product claimed to help people lose 30 pounds in six months by “eating yourself skinny”. In 2006 and 2007, the pair started a Raw Minerals makeup line under Intelligent Beauty, which got sued by the owners Bare Minerals for making a fraudulent copy of their product (Maheshwari, 2016).

In 2010, Goldenberg and Ressler launched JustFab Inc. described on the company’s website as “a personalized shopping experience that gives you access to professional stylists and their hottest picks. Every woman deserves to have the season’s latest trends and style expert advice regardless of her location, schedule or budget. So we

JustFab CEOs

combined the convenience of online shopping with the luxury of having a personal shopper” (JustFab, 2010). Through a series of acquisitions and rapid growth, the company has grown globally and is now present in the United States, Canada, Spain, Netherlands, Germany, France, England, Denmark, and Sweden (JustFab, 2010).

The Mission statement taken from JustFab’s website says: “We aim to give our members the celebrity treatment through a fun and engaging personalized shopping experience offering an extensive collection of on-trend shoes, handbags, denim, and accessories.” (JustFab 2013).

ORGANIZATIONAL STRUCTURE

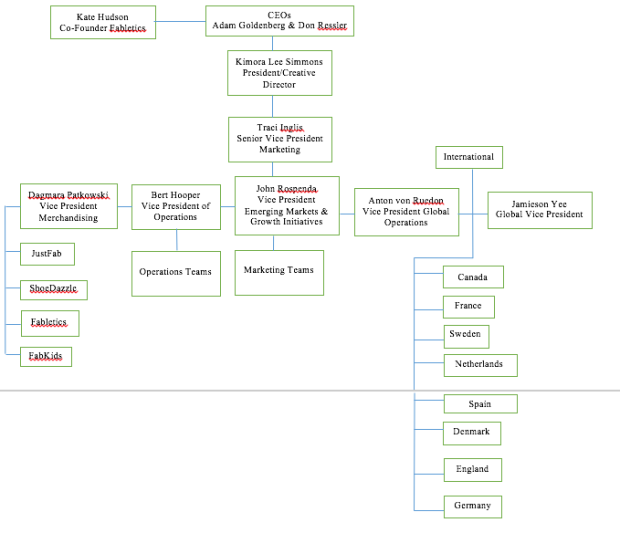

The headquarter of JustFab Inc. is located in El Segundo, California and as of 2015 had a company size of 2015 employees. Through its acquisition of related businesses in its industry namely ShoeDazzle, FabKids, and Fabletics, and its international presence in several countries, JustFab’s organizational structure has quickly moved from strictly a functional structure to a mix of functional and divisional structural grouping (JustFab, 2015 and Daft, 2010). In an attempt to keep all of its portfolio business relatively independent of each other, there appears to be very little utilization of resources across each business as portrayed through the company’s job listings page.

While a lot of the company’s business is not public, from my research, I have an understanding of JustFab’s organizational structure. At the top of the company’s organizational chart are the CEOs, Goldenberg and Ressler followed by Kate Hudson and Kimora Lee Simmons as co-founder of Fabletics and president/creative director, respectively. Other key people with significant influence on JustFab Inc.’s business include Josh Hannah as director and investor, and Traci Inglis as senior vice president of marketing, followed by over 485 employees in its chain of command (LinkedIn and Craft, 2015). See Appendix A for likely structure of the company’s organizational chart.

ENVIRONMENT & INDUSTRY

JustFab Inc. is one of the many online subscription-based companies in the retail business to consumer clothing industries fighting to get an increase in market share in a turbulent environment characterized by dynamic changes in styles and consumer needs. On Hello Subscription, a blog dedicated to reviewing subscription clothing programs, there are over 189 clothing subscription programs from over 1500 subscriptions. This is a booming industry considering that subscription programs were almost inexistent less than a decade ago (Hello Subscription, 2016).

In today’s society, fashion enthusiasts want to get their hands on clothing and shoes they see on the runway immediately. Businesses that excel on having quick turnaround time from runway to street wear at an affordable price such as Zara and H&M are guaranteed to make more sales (and probably more revenue) than their competitors who jump in later (Denning, 2015). Fast fashion is the order of the day and JustFab Inc. has mastered the art of finding out what its customers need and providing the answers to their needs in a timely fashion through the release of new styles (shoes, clothes, bags, jewelry) monthly at an average price point ($39.95) that gives the company a higher competitive advantage.

PROBLEM

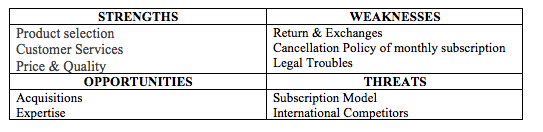

JustFab Inc. is a company that has exceled in growth and sales while other companies crumbled. In only six years, the company has grown to over 35 million subscribers locally and internationally from the United States and Canada to Spain, Netherlands, Germany, France, England, Denmark, and Sweden (JustFab, 2010). The company prides itself in its ability to answer consumer needs efficiently through the information its engineers and scientists are able to gather about customer behavior to efficiently meet demand (Page, 2015). Another key strength of the company is that it designs products in house and sources manufacturing and production in Asia to cut on cost. This cost-saving is then passed down to the consumer in addition to cutting out the middlemen (i.e. retail and departmental stores) (JustFab, 2010).

To date, JustFab has raised an unprecedented $249 million in 5 rounds of funding from 8 investors through Series A, B, C, and D rounds (CrunchBase, 2016). Being well aware that there is only so much that investors are willing to give towards a start up before demanding to see benefits (i.e. payout or exit strategy), there is a demand to meet the expectations of investors. Albeit the biggest challenge for JustFab Inc. at the moment is to meet the desires of investors through increased revenue (while keeping costs down). Following are three recommendations that the company can implement to boost revenue that have not already be considered or made public:

RECOMMENDATION 1: EXPANSION OF SUBSCRIPTION

The traditional clothing subscription service occurs by changing customers a monthly flat fee. Over the six years of its existence, JustFab has relied on this model of charging members $39.95 a month for access to VIP pricing. Some subscription services like Rocksbox has gone beyond this model by offering a cheaper membership fee of $19 with the option of applying $10 in store credit every month bringing down the cost for customers to $9/month. Another strategy being used by ScentBird, a perfume subscription company, is the option of purchasing a yearly membership plan that comes at a discount with additional perks like exclusive sales.

A few months ago, I heard that JustFab is beta testing a program for one-on-one stylist consultation with top spenders on the company’s website. If this program successfully kicks off, JustFab can utilize a lower membership fee like Rocksbox. The company can expect a higher membership registration and subsequent order rate with this program because as seen with Rocksbox, if a client decides not to keep any product sent to her that month, she lose out on the $10 store credit and the membership fee. A model like this will entice customers to make a purchase.

With the current system the company has in place, JustFab Inc. should look into expanding into a yearly subscription model. Client will be a flat fee and get access to a certain number of clothing (shoes, clothes, jewelry, and handbags) a year. So whenever the member needs anything, they can simply sign onto the website and place an order. This model will increase the switching cost (Porter’s 5 Forces) of customers to other competitors and will serve as a guaranteed revenue stream for the company as well as reduce rate of membership cancellation (Daft, 2010).

RECOMMENDATION 2: MENSWEAR LINE

It is general consensus that menswear cost more money than womenswear. A recent study found that men spend $10 more than women each month on clothing and accessories, 20 percent more time shopping than women each week, are twice as likely to shop online than women, and the menswear market is expected to expand almost twice the rate of womenswear (Cauterucci, 2016).

Image from Pinterest

This research goes to show that JustFab Inc. stands to make a promising chance of increasing its revenue by branching into the menswear industry. The company has already honed its skills on understanding the market for women’s’ clothing and should be able to transfer this efficiency into the menswear segment. This is the perfect opportunity for JustFab to become a leader in the menswear segment as clothing subscription industry is currently in the growth phase of the industry life cycle. Another benefit for the business is its ability to use its 35 million members more readily expand into the menswear segment. Along with this expansion comes the likely benefit of economies of scale and the ability to have more bargaining power when sourcing for manufacturers in Asia.

JustFab along with other U.S based clothing retailers have in recent years faced fierce price competition from international sellers based mostly in Asia. Majority of this competition appears to be in the womenswear category. By leveraging its international presence and its divisional structure, JustFab may be able to gain a significant market share in the online shopping clothing industry. The company has done a terrific job expanding into children clothing, plus size clothing, and athletic clothes so menswear is unlikely to be a difficult task for JustFab Inc. to accomplish.

RECOMMENDATION 3: ONE-STOP CLOTHING

Clothing mega-houses like Asos (U.K) and Zappos (U.S.A) make a lot of money by positioning themselves as a one stop shop for men and women clothing, and shoes, respectively. As JustFab continues to grow nationally and internationally, I believe that the company can increase its revenue by repositioning itself as the one-stop shopping for the family (men, women, and children). The company possesses a diverse portfolio of businesses and clothing and can create synergy across its business by offering a single platform for shopping similar to the technique that Gap, Old Navy, Banana Republic, and Athleta are doing on their websites.

Image from ShoeDazzle.com

At the moment, JustFab is focused on increasing its subscription-base in Europe and the United States through acquisitions of businesses in its segment and word-of-mouth referral from members who get $10 store credit for each new paying member (JustFab, 2010). While this strategy has been effective, I believe that the company has to start looking for new ways to turn its robust membership into higher revenue generation. Current media advertisements have focused on portraying each business under the JustFab umbrella of business as a single, stand-alone company. For customers to view JustFab Inc. as a one-stop shopping destination, the company has to reposition itself in the minds of consumers.

JustFab needs to take a proactive approach in pioneering new ways that it can tap into the pockets of its customers, thus, satisfying the needs of its investors as well as its customers. Well known companies like Amazon started with books and quickly grew into a household name. Similarly, JustFab started as a shoes-only subscription service and as grown to include clothes, jewelry, and handbag. I believe there is still room for growth not only into the menswear department but by having a crossover in its reach across its portfolio firms making JustFab Inc. a one-stop shop for trendy and affordable clothing for women, men, and children.

MANAGERIAL IMPLICATION

In order to generate more revenue outside of recruiting new membership subscription I believe that JustFab Inc. needs to consider expanding its subscription methods, entering and penetrating the menswear subscription segment, and morphing into a one-stop online store. These three recommendations appear feasible and well within the company’s capabilities.

In terms of expansion of the company’s subscription model, the engineering and marketing departments need to work together to analyze and create a model that will be suitable for the company while maximizing profit. The marketing department can work on a trial run of the potential new models by performing a small consumer study similar to the ones that are sent out to consumers after the purchase and receipt of an order. Based on customer reaction and feedback, JustFab can roll out its expanded subscription service.

For the expansion into the very lucrative menswear product line, the in-house design team, marketing, and procurement departments need to work together in order for this aspect to come to fruition. Again before such a large investment, consumer feedback would be very helpful. Managers may need to recruit and hire designers with experience in menswear to ensure that new styles blend seamlessly with the mission of the company. Production and procurement has to ensure that JustFab can efficiently source its product at the best price and quality that matches the company’s price points.

To be viewed as the one-stop shop for online clothing subscriptio n, JustFab needs to harness the unrealized synergy between its portfolio brands. All the departments and divisions of the company need to work together for this to be achieved. The engineering department can restructure the layout of all the separate firms to include a link to each other similar to what is done on the websites on Old Navy, Gap, Banana Republic, and Athleta. The marketing department and social media staff can help reposition the

n, JustFab needs to harness the unrealized synergy between its portfolio brands. All the departments and divisions of the company need to work together for this to be achieved. The engineering department can restructure the layout of all the separate firms to include a link to each other similar to what is done on the websites on Old Navy, Gap, Banana Republic, and Athleta. The marketing department and social media staff can help reposition the

company through frequent advertisement and social media posts across the company’s social networks. On Facebook alone, JustFab has almost 6 million Fans, ShoeDazzle 3.4 million, Fabletics 2.8 million, and FabKids 1.1 million not adding the combined several million followers these businesses have on other social network.

JustFab Inc. as a company can continue to expand its mission of giving members the celebrity treatment and extensive selection of products through the implementation of these creative and achievable solutions that will also increase the company’s revenue.

ORGANIZATIONAL CHART (Appendix A)

*Organizational chart is based on information gathered online from JustFab.com, Craft.co, and JustFab’s LinkedIn employee profiles.

SWOT (Appendix B)

*Recommendations above address threats of JustFab Inc.

REFERENCES

- (2010). JustFab frequently asked questions. Retrieved May 3, 2016, from http://www.justfab.com/faq.htm

- (2013). JustFab cares – Mission Statement. Retrieved May 3, 2016, from JustFab Cares, http://www.justfab.org/

- Daft, R. L. (2010). Organizational Theory and Design (10th). Cincinnati, OH: South-Western College Publishing.

- JustFab Inc. (2015). JustFab careers – job openings. Retrieved May 5, 2016, from JustFan Inc, http://corp.justfab.com/?action=careers.openings

- Denning, S. (2015, March 13). How agile and Zara are transforming the US fashion industry. Forbes. Retrieved May 7, 2016 from http://www.forbes.com/sites/stevedenning/2015/03/13/how-agile-and-zara- are-transforming- the-us- fashion-industry/#9d6d404c557f

- Page, P. (2015, July 2). Today’s top supply chain and logistics news from WSJ.The Wall Street Journal. Retrieved May 8, 2016 from http://www.wsj.com/articles/todays-top-supply-chain-and-logistics-news-from-wsj-1435834202

- (2016).JustFabulous Investors. Retrieved April 18, 2016, from CrunchBase, https://www.crunchbase.com/organization/justfabulous/investors

- Cauterucci, C. (2016, February 4). Men spend more money and time on clothes shopping than women. Retrieved May 8, 2016, from http://www.slate.com/blogs/xx_factor/2016/02/04/men_spend_more_money_and_time_on_clothes_shopping_than_women.html

- (2015, August 16). JustFab – JustFab Business Summary. Retrieved May 9, 2016, from Craft, https://craft.co/justfab

- Hello Subscription. (2016). Women’s Clothing & Fashion Subscription Boxes. Retrieved May 8, 2016, from hello subscription, http://boxes.hellosubscription.com/womens-clothing-subscription-boxes/#

- (2010). About JustFab – Who We Are. Retrieved May 8, 2016, from JustFab, http://www.justfab.com/story.htm

- JustFab Inc. Retrieved May 9, 2016, from LinkedIn, https://www.linkedin.com/company/justfab

- Maheshwari, S. (2016). The dark, Scammy history of JustFab and Fabletics. Retrieved May 8, 2016, from Business, https://www.buzzfeed.com/sapna/justfab-the-billion-dollar-startup-with-a-dark-past?utm_term=.mwpVxEn0b#.aqAQ7NE2d

This is fantastic! Could I use your blog as an example for future classes?

LikeLike

Absolutely! Thank you

LikeLike